How Do Markets Perform in Election Years?

August 15, 2016

With all of the seemingly constant coverage of the upcoming election, one of the questions we consistently get from investors is, “How does the President impact the market?” While it is true that the President will set polices that could impact economic results, the reality is that corporate America and consumers can adapt too quickly to change. There will be winners and losers, but the President typically doesn’t have as much influence as we think.

In fact, when looking back at all the 28 Presidential election cycles from 1900 to 2012, we see that market results are fairly similar. Of the of 28 four-year periods since 1900, only six produced negative results and those losing terms were split evenly between Democrats and Republicans (source: Oppenheimer Funds). All of the other 22 terms experienced gains.

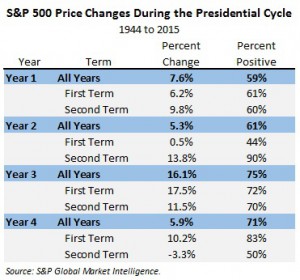

A different way to look at how the President impacts market results is to look at market returns during each year of a Presidential cycle. The adjacent chart, prepared by S&P Global Market Intelligence, gives us some insight into how the U.S. stock market has performed in election and other years.

The table groups, in the bold lines, market returns from each year of a President’s term. Of all the years in a Presidential cycle, the third year is typically the best performing year while the second year has historically been the worst. It is interesting to note that, when looked at in whole, the average returns from each year were positive. There wasn’t a calendar year where the average returns were historically bad.

The table also shows the difference in results between first term and second term Presidential cycles. The historical results from our current cycle (fourth year, second term) are not encouraging. The S&P 500 actually experienced an average decline of -3.3% in the last year of a Presidential cycle when the incumbent is termed out.

This kind of market reaction is understandable. Any change brings uncertainty and, as we’ve talked about many times before, investors don’t like uncertainty. Yet, we have to take these results with a grain of salt. There were only six periods where this historically occurred, so the data set isn’t robust. Further, given that the market is already up for the year and all three major indexes reached new highs last week, history may not repeat this year.